Rental car insurance is of utmost importance when renting a vehicle in Crete or any other destination. Rental car insurance offers an additional layer of security that lessens financial obligations in the event of mishaps, theft or damage to the rental car. Visitors are saddled with prohibitive repair or replacement expenses due to the unknown roads and driving conditions in Crete, so having sufficient insurance coverage assures that in case of an unanticipated mishap during their rental period. It gives visitors peace of mind and enables them to explore the island with assurance because they know they are ready for unforeseen circumstances.

Visitors choose from various insurance plans when renting a car in Crete. Insurances include personal accident insurance, theft protection, third-party liability insurance and collision damage waiver (CDW). Third-party liability covers harm done to other cars or property, CDW protects against theft and TP covers damage to the rental car. Personal Accident Insurance provides medical coverage in the event of an accident. Visitors are adequately covered when driving in Crete if they comprehend and select the right coverage options.

Understanding the procedures for a successful insurance claim process is crucial. First, inform the local authorities and file a police report if necessary. The occurrences are officially recorded as a result. Second, contact the rental company about the incident so they start the relevant processes and stay updated. Third, take detailed pictures of the accident scene and any damage the car has received to support their claim.

Fourth, visitors must be careful to fill out any necessary forms that the rental business has provided, as the forms are essential for the claims procedure. Gathering all required paperwork is essential, such as the police report and the rental agreement, to present facts and evidence. Fifth, get in touch with the company providing their rental car insurance to begin the claims procedure and get advice on what to do next. A smoother experience at such a hectic time is ensured by carefully following these procedures.

Drivers in Crete benefit from several perks from rental car insurance. Insurance protects individuals from financial stress in the event of mishaps, theft or damage, enabling them to appreciate their holiday without being concerned about prospective costs. Insurance gives protection from legal responsibilities brought on by third-party damages and reimbursement for medical expenditures in the event of injuries. The claims procedure is streamlined with insurance because it provides a standard operating procedure to follow in the event of an accident.

Individuals must understand its restrictions, although rental car insurance offers useful protection. Individuals are responsible for some expenses if a policy has deductibles or exclusions. Some activities are not covered, such as off-road driving or driving while intoxicated. The insurance for a rental automobile does not cover any lost or stolen personal property. One must make educated decisions and take extra measures if they are aware of these restrictions if necessary.

1. Report the Incident

Reporting the incident entails informing the appropriate authorities and parties of an incident involving an accident or damage to a rental car in Crete. Reporting the incident is a vital step since it starts the processes for filing insurance claims and legal proceedings while legally documenting the incident.

The local authorities, usually the police, must be contacted immediately if there is an incident involving a rental car in Crete. Give precise information about the incident’s time, place and any injuries suffered. It is essential to notify the rental car company promptly, informing them about the incident, the extent of the damage and the involvement of any other parties.

Reporting the incident is essential since it creates an official event record. The record of event documents serves as essential documentation for legal and insurance claims. Individuals help determine guilt and culpability by promptly and accurately reporting the occurrence and making sure the information is appropriately recorded. The document assists the rental car company in determining the damage’s extent and the best course of action for replacement or repair. Correctly reporting the issue guarantees transparency, accountability and a more efficient procedure for all parties involved.

2. Document the Damage

Documenting the damage to a rental car involves visually recording any visible harm or issues the vehicle has sustained. Documenting the damage comprises photographing or filming the damage from various angles and distances to offer a full visual record of the vehicle’s condition.

Documenting the damage one causes to a rental car is essential. Start by taking clear, comprehensive pictures of the damaged areas using a camera or smartphone, including up-close photographs and larger views demonstrating the context. Document any dings, scratches or other damage, along with their location and degree. Make a note of any damaged components or add-ons inside the car, if appropriate.

Documenting the damage to a rental car is important for several reasons. First, documenting the damage serves as evidence to support their case during the claims procedure, providing visual documentation of the state of the car previous to the incident. The document helps individuals and the rental company avoid conflicts over the level of damage. Second, proper record-keeping shields them from being blamed for pre-existing damage that was not their fault. Individuals prevent being unfairly charged for repairs that were not their fault by having photographic proof.

Third, well-documented damage speeds up the process and results in quicker resolutions in cases of insurance claims or legal concerns, saving them time and stress. Proper documentation is a proactive measure that equips individuals to truthfully portray the scenario and safeguard their interests when dealing with rental car damage.

3. Involve Authorities (if necessary)

Involving authorities refers to the act of notifying and engaging local law enforcement, such as the police, in the event of an accident or damage to a rental car. Notifying the local law enforcement involves reporting the incident and allowing the authorities to document the details, gather evidence and file an official police report.

Calling the local authorities right away is essential if there is an accident or damage to their rental automobile in Crete. Invite the police to the accident location and give them complete and truthful details of what happened. Give the police permission to investigate, acquire data from all parties and report their findings. Tell the truth about what happened is essential and work closely with law enforcement.

The involvement of authorities is critical in the Crete vehicle rental insurance claim process. Involving authorities guarantees an objective and reliable account of the incident or damage, which is used as compelling proof when filing an insurance claim. Important information concerning the incident, including the date, time, place, people involved and their statements, is detailed in the official police report. The report helps confirm the integrity of the claim, stop fraud and give a comprehensive picture of the facts surrounding the incident. The police report is used by rental businesses and insurance companies to make accurate judgments, resulting in a faster and more effective claims resolution process.

4. Contact Your Insurance Provider

Contact the insurance provider immediately if the rental car is involved in an accident or suffers damage in Crete. The insurance provider is a valuable resource as they work through the incident’s aftereffects and begin the claims procedure. Contacting the insurance provider enables people to give all the required information while the specifics are still fresh in their minds. Reaching out to the insurance company when dealing with damages, theft or any other covered occurrence guarantees that they follow the correct procedure and take the required actions to handle the matter.

Contacting the insurance provider entails informing them of the incident and giving them any necessary information. The report includes details regarding the collision, damage to the rented automobile and any relevant data, including police reports or pictures. The insurance provider walks individuals through the claims procedure, outlining the necessary paperwork and actions they must take. They work with people to determine the full extent of the damage and ensure they get the proper settlement following the insurance policy.

The most crucial thing to do after an accident involving a rental vehicle is to contact the insurance provider. Contacting the insurance provider is the initial step in formally stating the claim and requesting aid for financial obligations. The insurance provider explains the benefits to them, walks them through the claims procedure and ensures they know what steps they need to take. Visitors speed up the processing of their insurance claims and reduce some of the stress that frequently comes with such circumstances by promptly calling their insurance provider. Navigating the effects of an accident or damage to a rental car benefits greatly from their knowledge and advice.

5. Provide Supporting Documentation

Providing supporting documentation refers to the collection of supplementary materials, records or evidence that substantiates claims, transactions or events. Supporting documentation gives diverse procedures and claims context, correctness and credibility, providing a solid basis to base judgments, verify assertions or carry out audits.

Keeping track of supporting documentation is an essential practice in many circumstances. Individuals and organisations must ensure that all pertinent papers are obtained, arranged and saved, whether dealing with insurance claims, financial transactions, legal issues or academic study. Supporting documentation comprises documents that directly pertain to the topic, such as receipts, invoices, contracts, pictures, correspondence, reports, etc.

Supporting documentation gives statements and actions transparency and authenticity, assisting in avoiding disagreements and misunderstandings. Supporting documentation helps with budgeting, auditing and regulatory compliance while ensuring the accuracy of financial data. Providing credible evidence is essential in developing a solid case in legal situations. Providing credible evidence gives discoveries in academic studies more integrity and credibility. Accurate documentation facilitates fair judgments, avoids uncertainty and expedites processes, including insurance claims. Supporting documentation is essential to ethical record-keeping and assessment in the personal and professional realms.

6. Follow-Up

Follow-up refers to the sequence of activities and communications after an accident or damage to a rental car has been reported and an initial claim has been lodged in the context of car rental insurance claims in Crete. Following up is keeping in touch with the rental agency and the insurance provider to give any further details, proof or updates required for the claim procedure. The claim is processed quickly and effectively by taking a proactive approach, avoiding delays and issues.

Participating in effective follow-up after the initial stages of reporting an accident and beginning the insurance claim procedure is essential. Maintain consistent contact with the rental company and insurance provider to deliver the necessary information quickly. React quickly to any questions or requests for documentation. Keep track of all letters and communications regarding the claim. Ensure that both parties are informed of any updates or modifications to the claim, such as repair estimates or the discovery of new damages. A successful follow-up programme guarantees that the claim procedure stays on schedule and that any necessary adjustments are made as soon as they become necessary.

Follow-up is essential in Crete’s car rental insurance claim procedure because it expedites the determination of the claim. Following up regularly and thoroughly demonstrates individuals’ dedication to finding a solution, which makes it simpler for the rental company and the insurance provider to handle the issue quickly. Following up helps avoid misconceptions and ensures all pertinent information is appropriately communicated. Keeping involved and responsive throughout the process increases the rate of a successful and speedy settlement, overcoming the difficulties posed by accidents or damage to a rental car and keeping one’s peace of mind while travelling.

What is the Importance of Rental Car Insurance in Crete?

The importance of Rental Car Insurance in Crete is to give people the necessary financial security and peace of mind. Unfamiliar roads increase the risk of accidents and damage to rental cars in Crete, as do various driving conditions and probable language hurdles. Rental car insurance is a form of protection, covering the expenses of repairs, replacement or liabilities in the event of an unforeseen catastrophe. Individuals who do not have sufficient insurance are held liable for large repair fees, hurting their budget and whole trip experience.

Concrete examples are used to emphasise the value of rental car insurance. Statistics show that Crete’s twisting roads and varied topography result in a higher frequency of traffic accidents compared to more accustomed driving settings. Language issues make it difficult to communicate effectively with neighbourhood authorities and rental businesses after an accident, underlining the value of insurance that closes the gap.

The financial burden of repairs or replacements is significant, upsetting trip plans and adding unnecessary stress without insurance. The need for rental car insurance is further emphasised by testimonies from travellers who have experienced unforeseen incidents without insurance. Visitors getting full car rental insurance while on Crete is a smart move that lets them explore the island without worrying, even if there are problems.

What is the Basic Car Insurance for Rental Cars in Crete?

The basic car insurance for rental cars in Crete typically comprises a Collision Damage Waiver (CDW) and Third-Party Liability coverage. Collision Damage Waiver (CDW) covers damage to the rental vehicle up to a specified maximum, whereas Third-Party Liability covers damage to other vehicles or property caused by the rental car. Rental car, including insurance, provides critical protection for the car and third-party claims in the event of an accident.

The scope of basic rental car insurance becomes more transparent as one looks at its parts in more detail. A Collision Damage Waiver (CDW) protects the renter from being financially responsible for replacing or repairing the rental car if it is damaged in an accident or sustains damage. Collision Damage Waiver (CDW) is beneficial in Crete because unknown routes and varying road conditions increase the risks of minor accidents.

Third-party Liability coverage is essential since it protects the renter from any legal and financial repercussions if the rental car damages other cars or property. Visitors having Third-Party Liability coverage is a lifesaver while travelling to a foreign country, including Crete, where difficulties with language and regional legal systems arise. Car rental insurance coverage in Crete makes sure that basic car insurance for rental cars in Crete reduces financial risk and legal issues that emerge from accidents, helping visitors touring the island drive safer and more confidently.

Is the Car Insurance for Rentals Mandatory in Crete?

Yes, car insurance for rentals is mandatory in Crete. Greek law mandates a minimum insurance coverage for all on-road vehicles, including rental cars. The legal necessity ensures that everyone, including the driver, is financially covered in the event of accidents or damage. The driver faces legal repercussions, fines and liabilities if insurance in a rental car is inadequate.

Renter’s insurance is a practical and legal requirement for visitors to Crete. Accidents and incidents are prone because of the unknown roads, varied driving conditions and language hurdles. Travellers risk being liable for significant repair or replacement costs without sufficient insurance. Rental firms frequently provide insurance solutions to help tenants adhere to legal obligations and reduce their financial exposure.

How Much is the Average Car Insurance for Rentals?

The average car insurance for rentals in Crete ranges from €10 to €20 per day. Basic car insurance comprises fundamentals such as Collision Damage Waiver (CDW) and Third-Party Liability insurance, offering defence against claims involving the rental vehicle and third parties. The typical price ranges between €30 and €40 per day for individuals looking for more complete coverage, which includes extras involving theft protection and personal injury insurance.

Several factors contribute to the variety in Crete’s car rental insurance costs. The kind and scope of coverage chosen greatly influence the cost of the policy. Basic coverage is typically less expensive and covers essential risks, including harm to the rental car and third-party liability. The increased expense of more thorough coverage alternatives reflects the additional protection and peace of mind they offer.

Rental firms in Crete have different pricing strategies, so travellers must browse around, compare insurance packages and evaluate their specific needs before making a purchase. The value of the insurance is found in the financial security it provides and in the certainty that travellers take pleasure in their trip without worrying about unforeseen costs due to mishaps or damage. Travellers wisely choose when acquiring car insurance for their rental vehicles in Crete if they are aware of the cost range and have considered it in relation to the benefits and hazards.

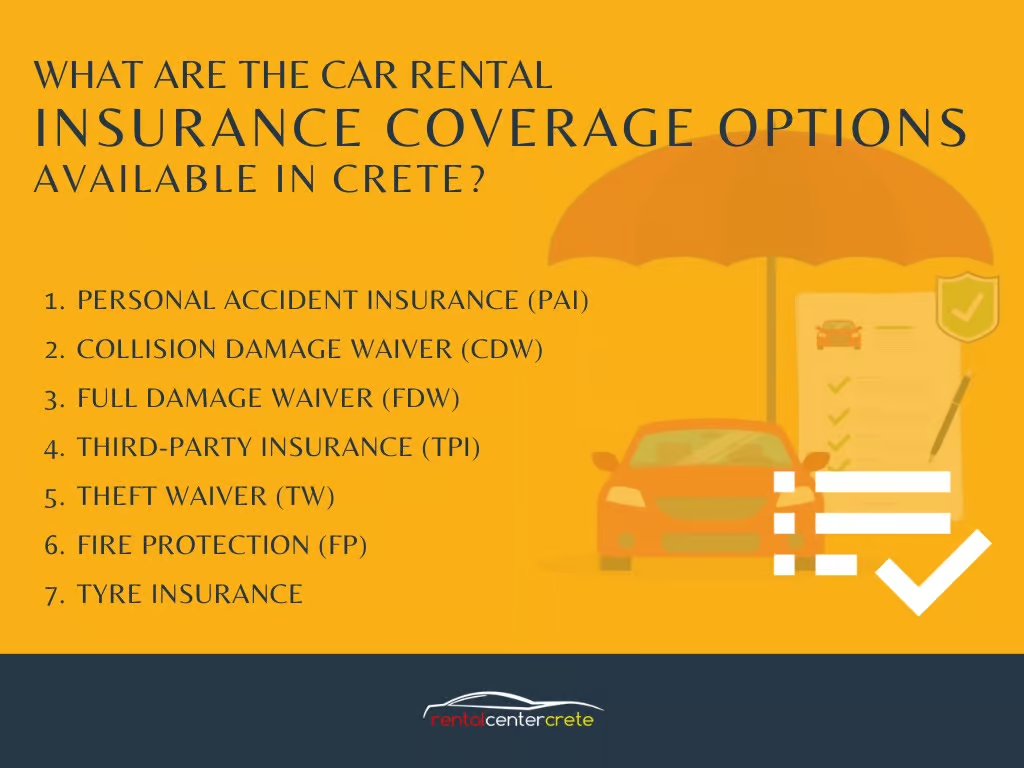

What Are the Car Rental Insurance Coverage Options Available in Crete?

The car rental insurance coverage options available in Crete are Personal accident insurance (PAI), Collision Damage Waiver (CDW), Full Damage Waiver (FDW), Third Party Insurance (TPI), Theft Waiver (TW), Fire Protection (FP) and Tyre insurance. Renters choose from various car rental insurance plans in Crete to give them specialised protection while travelling. The car rental insurance coverage options offer a variety of precautions and consider different risk factors.

Personal Accident Insurance (PAI) pays for medical costs and offers compensation if the driver or passengers are hurt. Collision Damage Waiver (CDW) reduces financial obligation, which pays for damages to the rental car in the event of an accident. Full Damage Waiver (FDW) supplements CDW by lowering or removing the deductible amount that renters must pay in the event of damage. Third Party Insurance (TPI) covers third-party vehicle or property damage liabilities.

The Theft Waiver (TW) guards against car theft in rentals. Fire Protection (FP) insurance covers losses caused by fires. Tyre Insurance provides coverage for tyre damage, which is helpful given Crete’s road conditions. Renters have the freedom to select the degree of security that best meets their needs and vacation objectives due to these coverage options, assuring a safe and stress-free experience while touring the island.

1. Personal accident insurance (PAI)

Personal Accident Insurance (PAI) is an optional policy provided by Crete vehicle rental companies. Personal Accident Insurance (PAI) offers financial security for the driver and passengers in the event of physical harm or unintentional death brought on by an accident while operating the rental car.

Personal Accident Insurance (PAI) pays compensation for injuries suffered by the driver and passengers in the rental car and provides coverage for medical costs. The cost per day to benefit PAI is 1.5€. The coverage is up to a set maximum, which differs based on the insurance company and the policy selected. The limit often covers the expense of hospitalisation, medical care and even benefits for accidental death or disability.

PAI includes coverage for ambulance bills, emergency medical transportation, incidental expenses incurred as a result of the accident, medical costs and compensation for damages or death.

Consider personal accident insurance for travellers who desire an additional level of safety for themselves and their passengers. Personal Accident Insurance (PAI) is helpful for people who need more complete health insurance or are worried about paying for medical care while travelling.

One of the advantages of Personal Accident Insurance (PAI) is the assurance that accident-related medical costs and compensation are covered, regardless of responsibility. Personal Accident Insurance (PAI) provides financial assistance during trying times and lessens the strain of unforeseen medical expenses.

Personal Accident Insurance (PAI) gives travellers important security, but it’s important to determine if the benefits are worth the cost. Travellers do not need PAI if they already have comprehensive health insurance covering incidents overseas. The coverage limitations and terms of PAI policies differ, so it’s essential to grasp the specifics before making a decision.

Rental Center Crete includes Personal Accident Insurance (PAI) without any additional cost, within the Premium Insurance Package offered in all car rental quotes.

2. Collision damage waiver (CDW)

Collision Damage Waiver (CDW) is a rental car insurance policy that pays for the expense of repairing or replacing a rental car if it is damaged in an accident or collision. The Collision Damage Waiver’s purpose is to reduce the renter’s financial responsibility for any physical harm caused to the rental vehicle. Rental firms frequently offer CDW to give customers insurance against unanticipated damage while driving the rented car.

Collision Damage Waiver (CDW) normally covers rental car damages such as dents, scrapes and other collision-related damage. The price of a Collision Damage Waiver (CDW) changes based on the rental agency, the vehicle type and the length of the rental. The daily cost of CDW ranges from a few euros to roughly €20 or more, depending on the coverage level and the insurance policy’s exact terms.

Checking the policy details is essential because CDW has specific inclusions and exclusions. All CDW plans do not cover off-road driving, negligence or drunk driving damage. Additional coverage options are available to improve the protection offered by CDW, such as lowering the deductible or incorporating coverage for theft and other hazards.

CDW is recommended for most renters, especially travellers who want to mitigate the financial risk of damage to the rental car during their trip. Travellers unfamiliar with the local roads and driving conditions and people visiting locations with a higher accident rate must strongly consider CDW to ensure a worry-free rental experience.

The main advantage of CDW is the peace of mind it gives renters, enabling them to drive without worrying constantly about minor accidents and the costs involved. The Collision Damage Waiver (CDW) adds an extra layer of security that helps shield against unforeseen costs and any disputes over damages with the rental agency.

The Collision Damage Waiver (CDW) has several restrictions despite its advantages. The renter must pay deductibles in the event of damage, which leads to further out-of-pocket costs. CDW does not cover specific damage kinds or dangerous driving practices. Renters must thoroughly read the policy’s terms and conditions and comprehend the coverage limits and exclusions before making a choice.

3. Full damage waiver (FDW)

Full Damage Waiver (FDW) is a rental car insurance policy available in Crete that offers thorough protection against any damage to rented vehicles. The Full Damage Waiver (FDW) exceeds the standard Collision Damage Waiver (CDW) by reducing or eradicating the deductible that the renter is typically required to pay in the event of vehicle damage. Full Damage Waiver (FDW) provides better peace of mind by greatly lowering the renter’s financial liability for any accidental damage that happens during the rental period.

The Full Damage Waiver (FDW) covers a wide range of damages to the rental car, including collisions, accidents, dings, scrapes and other incidental damage. FDW often lowers the deductible amount to a minimal or zero level, guaranteeing that the renter is not responsible for most of the repair costs, in contrast to the Collision Damage Waiver (CDW), where a deductible is applicable. Inclusions differ depending on the terms and conditions of the rental provider, so it’s essential to read the policy details before making a decision.

The price of a Full Damage Waiver (FDW) varies according to the rental agency, the kind of car and how long the rental is. The price of the Full Damage Waiver (FDW) ranges from €5 to €15 per day on average. Full Damage Waiver (FDW) must be a consideration for travellers who value total peace of mind and want to reduce their out-of-pocket costs for car damages. The Full Damage Waiver (FDW) is especially helpful for individuals who are uncomfortable with high repair expenses in the event of an accident or damage.

The main advantage of a Full Damage Waiver (FDW) is that it lessens the renter’s financial responsibility. Renters drive worry-free with a low or no deductible because they are covered for most damage-related expenses. The claims procedure is streamlined because there is less haggling over deductible levels with FDW. FDW appeals to anyone who wants to reduce financial risk while experiencing Crete and its various road conditions.

FDW offers better coverage, but weighing the costs against the benefits is essential. The insurance cost increases based on the length of the traveller’s rental and the conditions set forth by the rental agency. Renters must read the fine print to determine the scope of coverage, as some policies have exclusions or limitations. FDW is unnecessary for travellers who are already covered by different insurance policies, such as credit card coverage or personal car protection. Travellers must carefully consider their personal circumstances and preferences to decide whether the benefits of FDW outweigh any drawbacks.

4. Third-party insurance (TPI)

Third-party insurance (TPI) is a type of car rental insurance coverage available in Crete that expressly covers liability for damage to third-party vehicles or property. Third-party insurance (TPI) is intended to shield the renter from financial obligations from accidents for which they bear responsibility, avoiding severe financial and legal ramifications.

Third-party insurance (TPI) typically ranges from €5 to €10 per day. Third-party insurance pays for costs associated with damage to other cars or property due to the renter’s conduct while operating the rental car. Third-party insurance (TPI) costs vary according to the rental business and the amount of coverage selected. Third-party insurance (TPI) is a cost-effective alternative for people seeking necessary protection without the added expenditure because the price is substantially lower than more complete coverage options.

Third-party insurance typically excludes coverage for damages to the rental vehicle in favour of covering harm to third parties’ property or vehicles. Additional items such as Personal Accident Insurance (PAI), Collision Damage Waiver (CDW) or Theft Protection (TP) need to be individually evaluated if renters want broader coverage.

Third-party insurance is ideal for people who want to meet the legal requirements for driving and renting a car in Crete without paying hefty insurance prices. Third-party insurance (TPI) is a sensible choice for people who value defence against legal obligations to third parties but are prepared to bear some responsibility for the harm done to their own vehicle.

The main advantage of third-party insurance is that it protects renters from heavy financial responsibilities if they damage another person’s property or vehicle. Third-party insurance (TPI) ensures that people follow the law and drive safely without worrying about paying for all incidents.

The main drawback of third-party insurance is its limited range of coverage. Third-party insurance (TPI) does not offer coverage for harm to the rented car, so the renter is still liable for these costs. Third-party insurance (TPI) does not entirely remove the risk of legal and financial disputes in the event of accidents, which causes some stress or inconvenience, although TPI lessens financial liability for third-party damages. People looking for a rental car with more extensive insurance must consider purchasing additional coverage.

5. Theft waiver (TW)

Theft Waiver (TW) is an option for rental car insurance in Crete that offers protection and coverage against the theft of the rented car. Theft Waiver (TW) is intended to relieve renters’ financial burden in the unfortunate event that their rented car is stolen during their rental time.

Theft Waiver (TW) generally pays the full cost of the rental car if it is stolen, letting the renter avoid being liable for the full value of the vehicle. Theft Waiver (TW) rates differ according to the rental agency and the type of vehicle rented, but they typically run from €5 to €15 each day.

Theft Waiver (TW) additionally provides insurance against burglaries or attempted thefts resulting in damage to the rental car and theft coverage. Theft Waiver (TW) is helpful in Crete, where theft occurrences happen despite being very uncommon.

Travellers must consider Theft Waiver insurance in Crete for complete peace of mind during their rental period and want to avoid any financial repercussions in the event of vehicle theft. A Theft Waiver (TW) is advantageous for travellers renting pricey or luxury cars because of its increased replacement value.

The main advantage of the Theft Waiver (TW) is that it protects renters from the expense of repairing the rental car in the event that it is stolen. Theft Waiver (TW) reduces unforeseen costs significantly and provides a stress-free vacation experience. Theft Waiver (TW) is helpful for tourists visiting foreign countries, including Crete, where vehicle theft is common.

Theft Waiver (TW) adds a daily fee to the rental, which is not essential for all travellers, even if it offers valuable security. Renters must take steps to safeguard their items because the Theft Waiver (TW) frequently does not cover personal property stolen from the vehicle. Renters must be aware of any unique terms or demands connected with TW, such as the necessity of filing a police report in the event of theft. Renters must consider the cost of the Theft Waiver (TW) versus their demands and situations, even though it offers security.

6. Fire Protection (FP)

Fire Protection (FP) is a type of car rental insurance coverage that expressly tackles the danger of fire damage to the rental vehicle. Fire Protection (FP) guarantees that the associated repair or replacement costs are covered if the rental car sustains damage due to fire-related occurrences.

Fire Protection (FP) normally covers the cost of repairing or replacing the rental car if it is damaged due to a fire. The cost of Fire Protection (FP) varies based on the rental business and the type of vehicle rented, but it is typically added to the rental cost as an additional daily fee.

Some Fire Protection (FP) policies cover associated risks, including damage brought on by smoke or explosions and fire damage. The particular information and conditions differ between rental businesses, so reading the policy details is essential.

Travellers who want to be ready for the unanticipated risk of fire damage to their rental car must consider Fire Protection (FP), particularly in areas where wildfire dangers or other fire-related accidents are of concern. Fire Protection (FP) provide travellers who are exploring areas, including Crete, where there are fire risks peace of mind.

The main advantage of Fire Protection (FP) is that it protects renters against the potentially high costs of fire damage to the rental car. Fire Protection (FP) ensures the renter is not financially responsible for a fire-related occurrence, allowing them to continue travelling unhindered.

One potential disadvantage is that Fire Protection (FP) raises the total rental costs. Some travellers discover that fire damage is already covered by their insurance or credit card benefits, eliminating the need for an additional fee. It is crucial to carefully evaluate one’s unique demands and current coverage to avoid paying for unnecessary protection before choosing Fire Protection (FP). Fire Protection (FP) policies, including other rental car insurance alternatives, contain limitations and exclusions that renters must be aware of to make informed selections regarding their coverage.

7. Tyre Insurance

Tyre insurance is intended to pay for the expense of repairing or replacing damaged tyres on the rented car. Tyre insurance is frequently given as an add-on option to car rental insurance packages. Tyre insurance is quite useful in places, including Crete, where unexpected tyre damage is frequent and the road conditions change.

Tyre insurance often pays for repairing or replacing damaged tyres, including sidewall damage, blowouts and punctures. Tyre insurance includes harm brought on by road hazards, including potholes, debris and collisions with curbs.

Tyre insurance rates vary depending on the rental provider and the details of the coverage. The cost ranges from a few euros per day to a predetermined charge for the duration of the rental period and it is frequently offered as an add-on to the total rental car insurance package.

Some tyre insurance policies cover other vulnerable car parts, including the windscreen, windows and covering tyres, giving travellers a more complete security package.

Travellers who intend to explore Crete must consider tyre insurance, especially in rural or less developed places where road conditions are difficult. Tourists must choose tyre insurance if they want peace of mind and to prevent unforeseen costs related to tyre damage.

Financial security is the main advantage of tyre insurance. Financial security ensures travellers do not have to pay for tyre repairs or replacements, which are expensive, especially if they are driving through uncharted territory. Renters continue travelling unhindered due to tyre insurance, which gives them peace of mind.

The added expense of tyre insurance is one disadvantage. Travellers decide to forego tyre insurance to save on rental costs, even if it is helpful in some circumstances, especially if they are comfortable with their driving abilities and plan to adhere to well-maintained highways. It’s essential to thoroughly check the terms and conditions to understand the scope of coverage and any deductibles, because policies have specific limitations or exclusions.

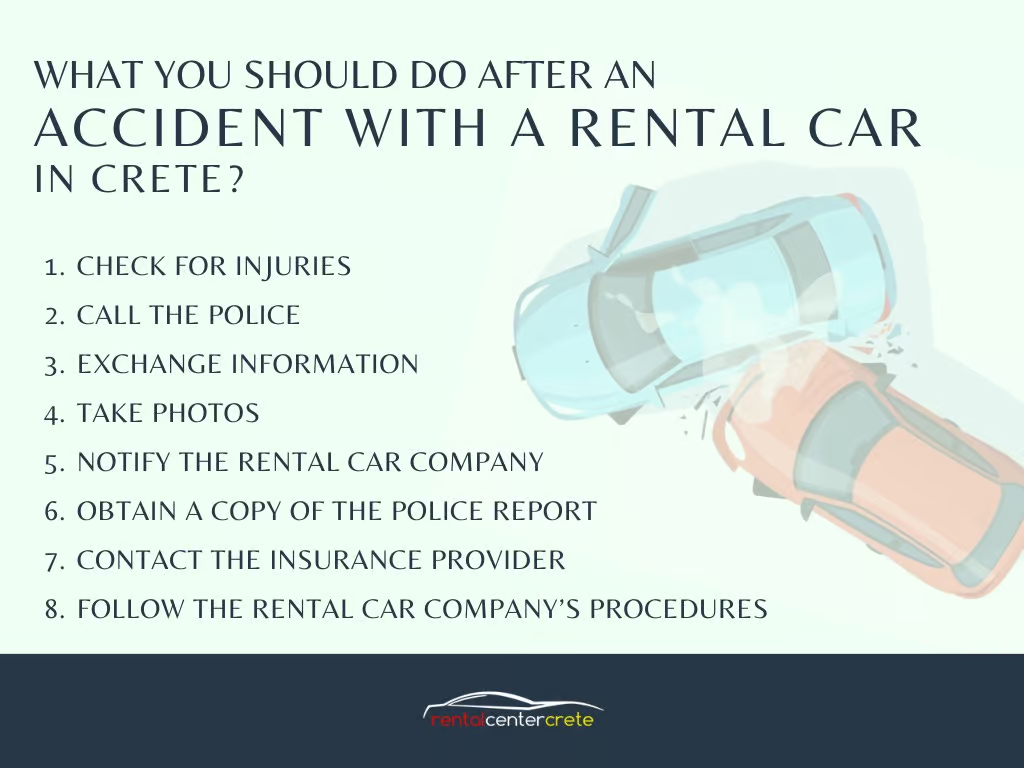

What You Should Do After an Accident with a Rental Car in Crete?

Travellers should take immediate action, after an accident with a rental car in Crete, including checking for injuries, calling the police and exchanging information. Taking the actions ensures their safety, adheres to legal requirements and facilitates the insurance claims process after being involved in an accident with a rental car in Crete. People must follow the actions, prioritise safety, compliance with legal standards and obtain critical information for the insurance claim.

The first and most important thing renters must do is check for injuries among themselves, their passengers and anyone involved in the collision. Safety comes first and renters must prioritise getting or seeking medical help. Call the emergency services right away if there are any injuries. Checking for Injuries is essential for everyone involved in safety and the documentation of the incident for legal and insurance purposes.

Contacting the local police at the scene is recommended regardless of the severity of the collision. The police report is an important record for legal cases and insurance claims. The police report offers a formal narrative of the incident, which is very helpful in assessing responsibility and culpability. Cooperation with local authorities is crucial because they arbitrate the conflict, mainly if there are linguistic difficulties or conflicting reports of the incident.

Exchange information with the other accident participants after ensuring everyone is safe and calling the police. Obtain their names, addresses, phone numbers, licence plate numbers, car registration information and insurance details. Obtaining the contact information of witnesses who make statements regarding the accident is helpful. The information exchange is essential for notifying their rental car company of the occurrence and starting the insurance claims procedure.

1. Check for Injuries

Checking for injuries refers to the immediate and critical action taken by individuals involved in an accident, whether as drivers or passengers, to assess their physical well-being and the well-being of others in the aftermath of a collision or incident. Checking for injuries entails a visual and physical examination to find any visible or hidden injuries resulting from the force of the accident.

The necessity of checking for injuries after an accident must be executed. Checking for injuries is an essential and unavoidable step in protecting everyone’s health and safety. Accident-related injuries range in severity from small scrapes and bruises to serious, life-threatening conditions. Serious injuries go unnoticed without a thorough assessment, leading to delayed treatment and complications. Prompt medical treatment and intervention are made attainable by the early detection of injuries and such actions are crucial in avoiding further damage or problems.

The significance of looking for injuries is multifaceted. First, checking injuries puts the well-being of accident victims first, exhibiting a dedication to their well-being. Second, checking injuries enables prompt notification of emergency medical services when necessary, speeding up the response to casualties. Checking for injuries has legal and insurance implications because promptly documenting injuries helps with accident-related claims and legal actions. Checking injuries ultimately emphasises the significance of safety and human well-being as the top priorities in the wake of any automobile disaster, ensuring that people receive the care and attention they need.

2. Call the Police

Calling the police in the context of a vehicle accident entails contacting local law enforcement to respond to and document the incident. Calling the police leads to the preparation of an official police report that includes crucial information regarding the collision, such as its scene, date, time, involved parties and an initial determination of fault. Calling the police in a car accident is an essential initial action that promotes accuracy, justice and effectiveness, ultimately benefiting all parties.

Calling the police after a car collision is a must, especially if there are injuries or considerable damage. There are several reasons why it is necessary. First, the police report acts as a fact-based and legitimate record of the incident. The police report makes it simpler to establish the circumstances of the event and assess liability and insurance coverage. Second, a police report guarantees that everyone involved complies with the law, as it is frequently a need to report accidents to the authorities. Third, the presence of law enforcement assists in upholding peace and mediating conflicts between groups, particularly when misunderstandings or language issues emerge.

The significance of calling the police in the aftermath of a car accident must be emphasised. A Police report contributes substantially to the insurance claims process, above and beyond the legal requirement. Police reports are frequently used by insurance companies to evaluate the facts of an accident and assign blame. The claims procedure becomes more difficult and contentious without a police report, sometimes resulting in disagreements and delays in collecting compensation. The police report aids in ensuring that persons in need of medical assistance are quickly attended to in cases where there are injuries or several automobiles.

3. Exchange Information

The exchange of information in the context of a car accident refers to the procedure when people involved in the collision exchange personal information and relevant information. The exchange of information normally includes names, contact information, driver’s licence numbers, car registration details and insurance information. The exchange of information is an essential step following an accident to make sure that everyone has access to the information required for legal, insurance and documentation purposes.

The exchange of information is an absolute necessity following an accident, as it serves multiple vital functions. First, the exchange of information helps individuals engaged in the accident communicate and work together more effectively. It is essential in situations when conflicting or conflicting reports of the incident exist. Second, it satisfies legal requirements in many places because it is frequently required for individuals involved in accidents to share information with one another and with authorities. Third, the exchange of information is essential for starting insurance claims since it gives insurers the information they need to determine culpability and handle compensation. The resolution of the accident and any future claims are greatly delayed and convoluted without it.

The significance of information exchange must be stated. The exchange of information establishes the framework for an organised and open post-accident procedure. People who have access to the other party’s information appropriately report the occurrence to their insurance company, ensuring that the required paperwork and evidence are in place for a simple claims process. It helps in establishing accountability and liability, which are crucial for figuring out liability and fault for damages. The exchange of information is a crucial step that helps to resolve an accident and improves everyone’s safety and adherence to the law.

4. Take Photos

Taking photos is the practice of using a camera or smartphone to record visual images of a specific place, item or circumstance. Taking photos is a common way to visually record information in a variety of situations, such as after accidents or incidents. Taking photos is an important habit in a variety of areas of life, including travel, insurance and legal issues. Photos are a useful tool for preserving information and guaranteeing an accurate portrayal of events.

Taking photos is often required in a variety of situations, including accidents, rental car disputes and even recording personal belongings for insurance purposes. Taking photos offers a factual and visual record of what happened, which is very useful for correlating information, supporting allegations and facilitating investigations. Taking photos of the accident scene, the damage to the vehicles, the state of the road and any injuries is necessary for insurance claims, police reports and legal actions. It is difficult to precisely reconstruct events without photo evidence since important details are missed.

The value of taking photos resides in their capacity to offer a clear and unambiguous record of the current situation. Visual evidence is used to establish facts, back up assertions and settle arguments. Photos are useful in establishing liability in collisions involving rental cars, determining the level of damage and streamlining the insurance claims procedure. Photos are a useful tool for remembering specifics and supporting investigations, which lowers the risk of misunderstandings or conflicts.

5. Notify the Rental Car Company

Notifying the rental car company is the activity of notifying the rental provider of an occurrence or event involving the rental car, such as an accident, damage, theft or any other problem that needs their attention or involvement. Notifying the rental car company is an essential step in controlling and resolving any problems with the rental car that arise during the rental time.

Unforeseen circumstances that arise during the rental period must be reported to the car rental company immediately. The rental car company covers mishaps, damage, mechanical problems and even something as straightforward as a broken GPS device. It is necessary to carry out the duties of a renter and is a contractual duty stated in the rental agreement. Failure to inform the rental firm of any problems has negative legal and financial repercussions, such as additional fees or legal concerns.

The importance of notifying the rental car provider must be emphasised. First, notifying them enables the rental company to quickly analyse the problem and take appropriate action, such as setting up repairs, offering a replacement car, or, if necessary, aiding with legal proceedings. Second, the rental firm records the incident and offers essential details for insurance claims or legal matters, protecting the renter from culpability. A prompt resolution of any concerns and the avoidance of any complications in the future are all promoted by timely reporting, which guarantees that the renter and the rental firm execute their respective obligations.

6. Obtain a Copy of the Police Report

Obtaining a copy of the police report refers to the process of obtaining an official document prepared by law enforcement authorities that details the facts, events and findings relating to an incident, such as an accident or a criminal event. Obtaining a copy of the police report entails getting a formal report from the local authorities who reacted to the scene in the case of a car accident involving a rental car in Crete.

A police report must be obtained, especially following an accident involving a rental car in Crete. A police report provides an unbiased narrative of what happened and acts as a key legal and factual record of the incident. It is legally required to report accidents to the police in many countries, including Crete, making a report vital to comply with local laws and regulations. Obtaining a copy of the police report is an absolute necessity to guarantee a transparent and effective resolution of any problem involving a rental car in Crete.

The significance of having a copy of the police report must be highlighted. A police report serves as an important proof of insurance claims, legal disputes and liability assessments. The police report is used by insurance companies to evaluate the accident’s facts and establish the scope of coverage. A police report helps in establishing liability and is extremely useful in times of dispute or lawsuit. It offers a transparent and objective account of the incident, lowering the risk of misunderstanding or inaccuracy during the claims process.

7. Contact the Insurance Provider

Contacting the insurance provider refers to the act of contacting the firm or organisation responsible for providing the traveller’s insurance coverage, whether it’s for a rental car, health, house or any other sort of insurance. Contacting the insurance provider takes place for several reasons, such as to report an event, file a claim, get more information about the policy or talk about any problems relating to the coverage.

Contacting the insurance provider is required in various situations involving coverage or financial protection. For example, individuals must call their insurance provider if they are involved in an accident or if the rented vehicle is damaged in the case of rental car insurance. Timely reporting of the incident is essential in such instances so that travellers begin the claims procedure and enjoy the benefits and protection promised by their policy.

The significance of contacting the insurance provider must be emphasised. Contacting the insurance provider enables travellers to obtain the support and assistance they need in the face of unforeseen events or emergencies. Contacting the insurance provider immediately after an accident or other covered event to ensure that they are aware of the situation helps travellers through the claims process and gives them the tools they need to handle the issue quickly and easily. Failing to contact the insurance company in a timely manner leads to delays, complications or a lack of coverage when they need it most.

8. Follow the Rental Car Company’s Procedures

Following the rental car company’s procedures provided by the rental car provider while hiring an automobile is essential. The company’s procedures cover a variety of guidelines and standards that renters must abide by throughout the rental time, from vehicle pickup to vehicle return. They often include guidelines for checking the car for existing damage, accurately completing documentation, comprehending the rental agreement’s provisions and returning the car on time and in the predetermined condition.

A seamless and trouble-free rental experience depends entirely on adhering to the policies of the rental car business. The Car Company’s procedures are in place to safeguard the renter and the rental car provider. Following guidelines helps the rental company maintain the fleet’s condition and guarantees compliance with regulatory and insurance standards. The renter needs to do so to prevent any conflicts, unforeseen costs, or hassles during and after the renting time.

The necessity of following the procedures of the rental car provider must be emphasised. The first benefit is that it makes the rental transaction plain and transparent. Renters avoid being held accountable for problems they did not cause by checking the car for damage and recording it. The rental agreement’s terms and conditions must be understood to avoid confusion over charges, mileage restrictions and fuel usage guidelines. Returning the car on time and in the agreed-upon condition reduces the risk of further fees or conflicts. Following the procedures guarantees a hassle-free and profitable renting experience for the owner and the renter.

9. Seek Legal Advice

Seeking legal advice is speaking with an experienced lawyer or other legal expert to get direction and assistance about legal issues, rights and possible courses of action. Seeking legal advice is a proactive measure done by people or organisations dealing with complicated legal problems, disputes or circumstances where legal knowledge is necessary.

Seeking legal advice becomes necessary when individuals or organisations face legal difficulties that are beyond their understanding or competence to address on their own. Legal issues frequently contain complex rules, laws and prospective outcomes that have a big impact on someone’s freedom, finances or even rights. Legal counsel is essential in such situations for navigating the complexities of the legal system, making wise judgements and defending one’s interests.

The value of seeking legal advice is immeasurable because it offers several significant advantages. First, seeking legal advice ensures that people are aware of their rights and obligations, enabling them to make wise decisions and stay out of legal trouble. Second, seeking legal advice enables people to plan and achieve the best outcome because it provides professional insights into the advantages and disadvantages of a case. Legal specialists help with negotiations, document preparation and court representation to handle legal concerns with the utmost competence and knowledge. Seeking legal advice is a proactive move that encourages justice, fairness and the defence of one’s legal interests in a complicated and frequently difficult legal environment.

What are the Benefits of Rental Car Insurance in Crete?

The benefits of Rental Car Insurance in Crete are listed below.

- Collision Damage Waiver (CDW): CDW protects renters from being held financially liable for the full cost of repairs to the rental car in the event of damage brought on by accidents.

- Third-Party Liability Coverage: Third-Party Liability Coverage insurance protects renters against monetary and legal repercussions by taking care of responsibilities resulting from harm to other cars or property caused by the rental car.

- Theft Protection (TP): Theft Protection (TP) insurance protects against the theft of the rental car, sparing the renters from paying for a replacement and facing any legal problems.

- Personal Accident Insurance (PAI): PAI ensures that medical costs are covered in the event of an accident by providing coverage for medical bills and reimbursement in the event of injuries to the driver and passengers.

- Protection in Unfamiliar Terrain: Rental car insurance offers peace of mind, knowing that damage or accidents are financially manageable given the variety of roads and difficult terrains on Crete.

- Legal Compliance: Rental car insurance is frequently required, ensuring that renters abide by local rules and regulations and stay out of trouble in Crete.

- Simplified Claims Process: Rental car insurance makes resolving accidents, damage or theft easier by offering clear instructions and support, lowering stress during unplanned occurrences.

- Flexibility: Renters tailor their coverage to their specific needs and budgets, considering their risk tolerance and personal preferences.

What are the Limitations of Rental Car Insurance in Crete?

The limitations of Rental Car Insurance in Crete are listed below.

- Deductibles: Deductibles are the sums that renters must pay out-of-pocket before their insurance coverage begins to apply. Deductibles are a common feature of insurance contracts. High deductibles leave renters with substantial expenses in the event of an accident or damage.

- Excluded Activities: Some rental car insurance policies exclude coverage for specified activities such as off-road driving, racing or illegally operating the vehicle. Participating in such activities nullifies the insurance.

- Coverage Caps: Insurance policies frequently have caps on the amount of coverage. Renters are liable for the balance if the price of repairs or liability claims goes over these caps.

- Pre-Existing Damage: The insurance for rental cars normally covers any new damage or accidents that take place while the vehicle is being rented. The vehicle’s prior damage is not covered.

- Unauthorised Drivers: Insurance coverage is cancelled if a vehicle is operated by someone who is not specified as an authorised driver on the rental agreement and an accident results.

- Excluded Items: Rental car insurance typically excludes coverage for personal items kept inside the vehicle. A separate insurance policy or homeowners/renters insurance is necessary for theft or damage to personal property.

- Intoxication or Recklessness: Accidents or damage caused while driving recklessly or under the influence of alcohol or drugs are not covered by rental car insurance.

- Limited Geographic Coverage: Some insurance packages for rental cars limit where the car is driven. Entering restricted places results in coverage being cancelled.

What does Insurance Not Cover?

The common things that insurance does not cover are listed below.

- Pre-Existing Damage: Most insurance policies do not cover damage that existed before the policy was purchased or before the rental period began. The car must be thoroughly inspected and any damage must be reported to the rental agency before renting.

- Intentional Damage: Damage made intentionally by the insured or anyone else is not covered by insurance. Deliberate acts of vandalism or destruction are normally prohibited.

- Illegal Activities: Insurance normally does not cover any damages or liabilities caused while driving the vehicle for illegal purposes, such as illegal street racing or smuggling contraband.

- Off-Road Use: Many insurance policies do not cover accidents or damage that happen when the rental car is driven off-road or on dirt roads. Renters must exercise caution when driving under such circumstances.

- Unauthorised Drivers: Insurance coverage is cancelled if the vehicle is driven by someone who is not specified as an authorised driver on the rental agreement. Insurance coverage is limited to approved drivers.

- Personal Property: Theft or damage to personal property left in a rented car is often not covered by the insurance policy. Personal belongings must be covered by homeowners or renters insurance for travellers.

- Driving Under the Influence: Accidents or damage that happen when the motorist is intoxicated by alcohol, drugs or other substances are typically not covered by insurance.

- Racing and Competitions: Any damages incurred while participating in races or contests are often not covered by insurance. Racing and competitions include organised and unplanned events.

- Natural Disasters: Some insurance policies do not provide coverage for damage brought on by quakes, floods or hurricanes. Renters must read the policy to find out the specifics.

- Unauthorised Modifications: Unauthorised modifications to the rental car that cause damage are often not covered by insurance.

What Should I Consider when Choosing Car Rental Insurance in Crete?

One should consider the following when choosing Car rental Insurance in Crete.

- Type of Coverage: Recognise all of the types of coverage that are offered, such as Collision Damage Waiver (CDW), Third-Party Liability, Theft Protection (TP) and Personal Accident Insurance (PAI). Select the level of protection and coverage that best suits one’s needs.

- Policy Cost: Costs for insurance from various rental firms must be compared. Ensure one has the necessary coverage while balancing the cost of insurance with one’s budget. Examine current personal insurance policy to see if any of the coverage overlaps.

- Excess and Deductibles: Review the insurance’s deductible and excess payment levels. Consider risk tolerance when balancing higher premiums and lower deductibles.

- Choice of Vehicle: Insurance requirements are influenced by the kind and value of the rental car. Consider the vehicle’s condition, size and age when selecting coverage. High-end or luxurious cars need more extensive insurance.

- Habits of Driving and Terrain: Consider the anticipated driving style and Crete’s terrain. Additional coverage is advisable if renters want to go off-road or explore rural locations.

- Policy Exclusions and Conditions: Read the insurance policy’s terms and conditions carefully. Recognise any behaviours or situations that nullify coverage, exclusions, limitations and other restrictions.

- Duration of Rental: Consider the length of the rental. Daily insurance expenses build-up for longer leases. Extended coverage is available at discounted rates from some rental companies.

- Individual Insurance: Verify whether one’s current personal auto insurance, credit card rewards or travel insurance offers rental car coverage. Avoid getting extra insurance.

- Additional Options for Coverage: Examine extra coverage choices, such as tyre insurance or windscreen protection, in light of one’s preferences and Crete’s road conditions.

- Local laws and ordinances: Learn to follow the driving rules and insurance requirements in Crete.

- Evaluations and suggestions: Seek recommendations from fellow travellers, internet reviews or acquaintances who have leased cars in Crete to learn about dependable rental businesses and insurance options. It is essential to consider factors such as group size, luggage capacity and road conditions to make an informed decision on how to choose the right car to rent in Crete.

What Are the Consequences of Not Having Car Rental Insurance in Crete?

The consequences of not having Car Rental Insurance in Crete are listed below.

- Financial Liability: Damages or losses to the rental car result in travellers bearing financial responsibility if they do not purchase insurance. Financial liability includes the cost of repairs or the vehicle’s complete replacement value if it is damaged or stolen during the rental period.

- Legal Concerns: Driving a rental car without the necessary insurance has negative legal repercussions, such as fines and penalties. It results in legal problems and liabilities if renters are involved in an accident that causes injury to others or damages their property.

- Travel Schedule Disruption: Travel schedule disruptions and delays result from not having insurance if they are in an accident or if the rental car is damaged. The issue requires them to set aside time and resources, which impacts their schedule.

- Out-of-Pocket Expenses: Any expenses related to accidents, damage or larceny, such as towing fees, administrative fees and additional transportation costs, must be paid out-of-pocket without insurance coverage.

- Stress and Uncertainty: The absence of insurance contributes to significant stress and uncertainty in the event of an accident. The intricacies of conducting claims and repairs, language obstacles and new legal procedures present customer challenges.

- Damage to Personal Finances: Paying for vehicle maintenance or replacement out of pocket has a significant effect on a traveller’s vacation budget, which limits their ability to appreciate other aspects of their trip fully.

- Risk of Personal Injury Expenses: Travellers must be liable for any medical costs incurred if they or their passengers are hurt in an accident while driving a rental car and if they don’t have personal accident insurance (PAI).

- Lack of Liability Protection: Third-party liability insurance is crucial for handling losses or injuries brought on by accidents involving third parties. One must be subject to legal action and financial obligations without the coverage.

- Difficulty in Claiming Compensation: Attempting to collect compensation from third parties involved in accidents or damages is a difficult and time-consuming process, especially if one lacks the help of insurance providers.

- Rental Agreements That Are Voided: Some rental agreements have provisions that, if the insurance requirements are not met, render the agreement null and void, leaving them without a car and subject to cancellation fines.

Are there any tips for saving money on car rental insurance in Crete?

Yes, there are tips for saving money on car rental insurance in Crete. Examine if any current insurance policies, such as personal auto or travel insurance, cover rentals. There is less need for additional insurance in the rental business if one already has some degree of coverage.

Consider getting advance car rental insurance from a third-party supplier. They are frequently more affordable than the insurance provided at the counter by rental firms. Make sure the conditions and coverage limits are appropriate for the situation by carefully reading them.

Choosing the appropriate type and level of coverage depending on the individual’s needs is another way to cut costs. Comprehensive insurance provides renters with peace of mind, but it costs more. The risk tolerance and the road conditions in Crete must determine the required amount of protection.

Book in advance and shop around for the most affordable rental vehicle deals. Rental firms provide bundled packages with insurance at a discounted price. The best way to find inexpensive rental car insurance while seeing Crete is to be proactive and compare options.

Are there any restrictions for car rental insurance coverage in Crete?

Yes, there are restrictions and limitations for car rental insurance coverage in Crete and these restrictions vary depending on the rental company and the specific insurance policy one chooses. There are geographical restrictions that limit coverage to particular regions of Crete, restrictions on off-road driving, exclusions for activities such as racing or illegal use of the vehicle and prohibitions on unauthorised modifications to the rental car, among other common restrictions.

Coverage is void if an accident occurs while the driver is under the influence of alcohol or drugs and solely authorised drivers named on the rental agreement are normally covered. Some insurance does not cover losses brought on by calamities or unauthorised usage of the car. Visitors renting a car in Crete must carefully read the policy terms and conditions to comprehend these limitations and ensure they have adequate coverage for their travel needs while abiding by the policy’s limitations.

Can I use my own car insurance policy for rental cars in Crete?

Yes, you can use your own car insurance policy for rental cars in Crete, but it relies on the details of the policy and coverage. Rental cars within the same nation or region are frequently covered by personal auto insurance policies, including abroad in places such as Crete. The scope and restrictions of the coverage differ significantly between insurance firms and policies.

Contact the insurance company and inquire about the specifics of coverage for rental cars in other countries before relying on personal insurance. One must ensure that the insurance covers the specific kinds of vehicles that one intends to rent and provides comprehensive and liability coverage. Check for any policy exclusions, limitations or deductible amounts that apply when using personal insurance for rental automobiles.

One discovers that their insurance offers sufficient protection for their needs in Crete, saving them the expense of getting supplementary rental car insurance. One must carefully consider their insurance policy’s conditions and individual travel circumstances before making a final selection to avoid unpleasant surprises in the event of an accident or damage when renting a car in Crete.

Is car rental insurance necessary when renting a car in Crete?

Yes, car rental insurance is necessary when renting a car in Crete. Driving in Crete is frequently prohibited without insurance coverage. Penalties and legal problems result from breaking the rules. The variety of Crete’s roads, mountainous topography and foreign driving environment all raise the risk of mishaps or damage to the rented vehicle.

Renters are prevented from paying the whole cost of repairs or replacement in the event of unanticipated events by having insurance coverage, which offers crucial financial security. Insurance simplifies claims by providing direction and support in difficult circumstances. Insurance is a good decision for anyone renting a car in Crete, even though the cost must be considered given the negative effects of not having it, such as legal issues and financial burdens.

Last updated on .